Thank you for visiting TopDissertationExperts.com. We will be glad to fulfill all your writing needs. Our aim is to provide satisfactory capstone and dissertation writing services to Master’s and Doctoral students. Our team of writing staff, editors, and customer support staff work 24 hours a day to ensure our customers are happy. We understand that most students nowadays are overwhelmed by numerous responsibilities including their studies, work, and family tasks. We have, therefore, developed exceptional services to ensure that students get expert help to complete their capstone projects or dissertations.

Value-Oriented Services

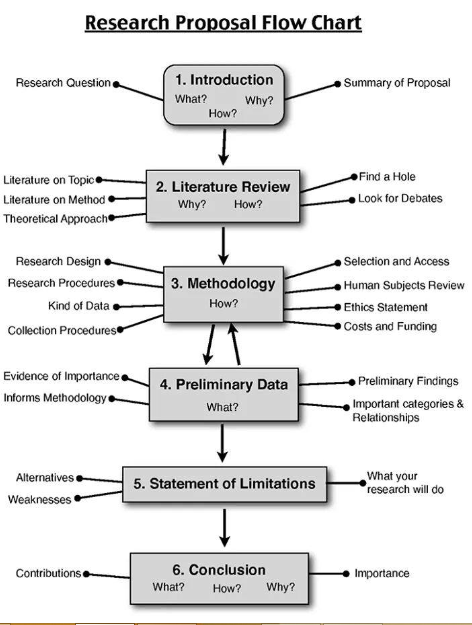

Our services are focused on providing value to our customers. We believe that obtaining custom writing services online should be an enjoyable process. Our customers are assisted promptly through our Live Chat. We answer all your queries regarding your capstone or dissertation, and we offer advice if you are not sure how to proceed with your project. Most students have challenges in selecting a proper title for their project, choosing the right theoretical or conceptual framework, choosing the design, and deciding the right statistical tests for the data collected. If you use our services to write your project or dissertation, you don’t have to worry about any of the technicalities because our experts will help.

A Culture of Excellence

Over the years, we have built a culture of excellence in provision of capstone and dissertation writing services. We ensure that each customer’s needs are identified and the most ideal solution provided. Our brilliant customer support team obtain the instructions from the customer, follow up on the order by updating the customer regarding the progress of their order, and ensure that the order is submitted on time. Our editors review the capstone or dissertation to ensure that it is free of any grammar, language, or syntax errors. The work is also scanned to guarantee that it is free of plagiarism. We understand that most institutions require capstones and dissertations to be published; so we ensure that our products are of publishable quality. We apply the following higher order thinking skills in providing dissertation and capstone writing services: Critical thinking, analysis, evaluation, logic, and problem solving.

Dedicated Expert Writers

Bsc- Aeronautics Capstone HelpTo guarantee high quality products, we have trained some of the best writers in the market. Most of our clients are masters or doctoral students, therefore, we recruit writers with at least a masters or doctoral/PhD degree in the respective field. We only recruit writers who are native speakers of English. However, apart from academic excellence and writing experience, we also consider other qualities such as diligence and dedication to one’s profession in recruiting our writers.

Impeccable Editing

Every capstone or dissertation written by www.TopDissertationExperts.com has to be proofread and edited by our professional editors. In editing the paper, our editors consider the language, clarity of content, sentence structure, punctuation, grammar, and adherence to the indicated writing style. We ensure that the manuscript delivered to the client is impeccable.

Expert Statistical or Data Analysis Help

Many students require assistance in analyzing data obtained in their research or project. We have developed a solution for such students by providing flawless data analysis services for capstones and dissertations. We offer statistical analysis using SPSS, STATA, Excel, and R Software. After analysis, we present the data neatly in tables, graphs and charts. Then we provide clear descriptions and interpretation of each graphic.